$14k IN REBATE DOUGH-RAY-ME FOR YOU?

When I say there’s free money falling from the sky, I’m just not talking about the free electricity I get from the sun through my rooftop solar panels, or the tax incentive I banked for installing them back in 2015, or even the amount I get from Southern California Edison for generating more electric power than my house uses and putting it back into the grid to power my neighbors’ homes.

What I’m talking about is the up-front rebate money plus the back end tax credit money coming on-line later this year for you to ditch gas for heating your home, cooking your food, heating your hot water, and powering your personal transportation. You get the money for electrifying those things so they can all be powered by clean solar, wind hydro, geothermal or other available clean energy sources.

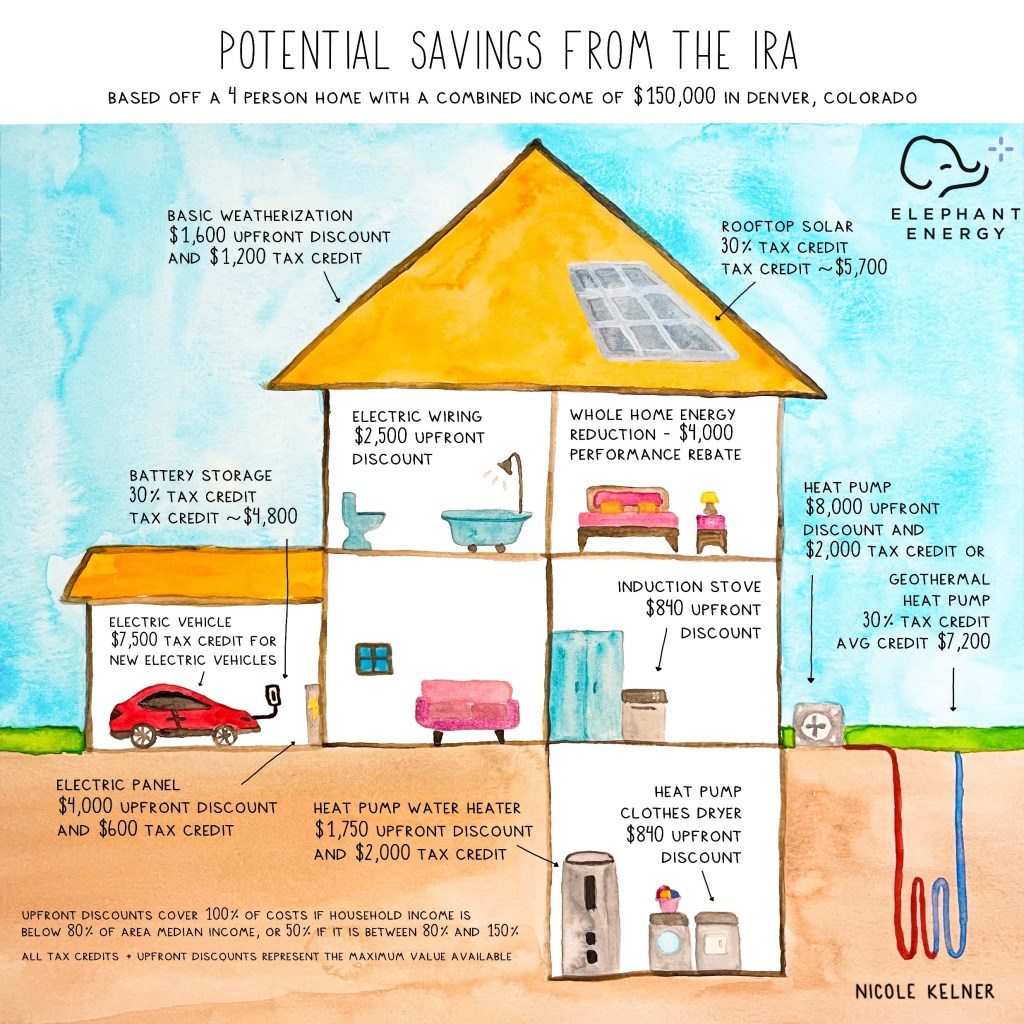

What kind of money? For qualifying homeowners, they can receive up to $14,000 in total rebates under the program. Here’s the fabulous visual summary Nicole Kelner made exclusively for the very cool Elephant Energy site

That’s the good news, and it’s all funded by the High Efficiency Electric Home Rebate Program part of the very stupidly named Inflation Reduction Act – the other IRA.

The bad news is – it’s up to each state to set up their own program to get the money to its citizens and each of those plans has to be approved by the Feds. So the money won’t begin flowing till the end of this year.

But the good news about that is it gives you the time you need to start getting up to speed and planning ahead. and if you’re in california, your state is only waiting for federal approval of their plan.

What do the rebates pay for?

$8,000 for a heat pump heating and air-condition system

$1,750 for a heat pump water heater

$840 for an electric stove/induction cooktop

$840 for heat pump clothes dryer

And since your current electric panel and wiring probably can’t handle that big new electric load there’s

$4,000 for an electric load main panel upgrade

$2500 to run those new 240V electric lines.

There’s also a $1,600 rebate for insulation, air sealing and ventilation work done to cut your need for heating and cooling and to improve your indoor air quality.

There are limits on the amount home-owning families can receive. To qualify for the rebates your family’s total annual income must be less than 150% of the average median income (AMI) where you live. Here’s where you can find out your AMI: https://ami-lookup-tool.fanniemae.com/amilookuptool

But what about those of you who are renters in homes or multi-unit housing? according to vox, renters are getting the short end of the stick:

“The list of what renters can do is short, especially compared to what a landlord has power over. The nation’s housing supply is diverse, and the IRA sets income limits for who qualifies for tax credits and rebates, so some exceptions do apply.

The good news is the IRS says that tax credits could also apply to renters and multi-family residences, as long as they meet the income limits spelled out in the law.

Instead of a full home renovation to accommodate a new heat pump or a major purchase like a new stove, a renter is going to want something that can be plugged in, like a window unit heat pump or a ductless heat pump clothes dryer. A cheap option is an induction burner that can plug into a regular 120-volt outlet; these can be purchased for as little as $50.

Tax credits only matter for people with enough tax liability to benefit from the offset. Many renters don’t fall into this category. So the IRA’s rebates are generally more helpful to renters because they lower the cost of buying an appliance or a home upgrade.”

One of the best sources of information on rebates, tax credits and other incentives whether you’re an owner or renter is the Rewiring America website:

EnergySage is another excellent source of info

And here are some more good resources:

KIPLINGER – INFLATION REDUCTION ACT TAX CREDITS ENERGY EFFICIENT HOME IMPROVEMENTS https://www.kiplinger.com/taxes/605069/inflation-reduction-act-tax-credits-energy-efficient-home-improvements

electrek – inflation reduction act calculator https://electrek.co/2024/03/27/inflation-reduction-act-calculator/

california energy commission – ira residential energy rebate programs faq https://www.energy.ca.gov/programs-and-topics/programs/inflation-reduction-act-residential-energy-rebate-programs/faq-ira

rep jimmy panetta’s clean energy tax credits https://panetta.house.gov/issues/clean-energy-tax-credits

marketwatch california solar energy credits – https://www.marketwatch.com/guides/solar/california-solar-tax-credits/

Energy.gov Home Energy Rebates Programs – https://www.energy.gov/scep/home-energy-rebates-programs

Leave a reply to DID THE STATE OF CALIFORNIA REALLY JUST PAY TO REMOVE MY GAS HOT WATER HEATER AND REPLACE IT WITH A STATE OF THE ART ELECTRIC HEAT PUMP WATER HEATER? – Climate Change Of Address Cancel reply